In his latest letter to investors, Cherry-Coke-sipping Warren Buffett went full fiction-peddle-tard. As the man who perhaps best rode the coat-tails of an ever-increasing wave of American credit expansion exceptionalism (only to come undone in recent times as that game ends), it is no surprise that he explains "for 240 years it’s been a terrible mistake to bet against America, and now is no time to start." We don't mean to rain on his parade too much, but the following charts suggest "nothing lasts forever" and time is ticking.

For a man who runs a massive, highly-levered portfolio of assets exposed to 'Murica, it is hardly surprising Buffett would utter the following:

"For 240 years it’s been a terrible mistake to bet against America, and now is no time to start.

America’s golden goose of commerce and innovation will continue to lay more and larger eggs.

America’s social security promises will be honored and perhaps made more generous.

And, yes, America’s kids will live far better than their parents did."

The trouble is - taking each statement...

Nothing lasts forever...

History did not end with the Cold War and, as Mark Twain put it, whilst history doesn’t repeat it often rhymes. As Alexander, Rome and Britain fell from their positions of absolute global dominance, so too has the US begun to slip. America’s global economic dominance has been declining since 1998, well before the Global Financial Crisis. A large part of this decline has actually had little to do with the actions of the US but rather with the unraveling of a century’s long economic anomaly. China has begun to return to the position in the global economy it occupied for millenia before the industrial revolution. Just as the dollar emerged to global reserve currency status as its economic might grew, so the chart below suggests the increasing push for de-dollarization across the 'rest of the isolated world' may be a smart bet...

The World Bank's former chief economist wants to replace the US dollar with a single global super-currency, saying it will create a more stable global financial system.

"The dominance of the greenback is the root cause of global financial and economic crises," Justin Yifu Lin told Bruegel, a Brussels-based policy-research think tank. "The solution to this is to replace the national currency with a global currency."

Innovation may be limited by the constant manipulation of government and central banks...

One feature of capitalism that is rarely discussed is the premium placed on cooperation and collaboration. The Darwinian aspect of competition is widely accepted (and rued) as capitalism’s dominant force, but cooperation and collaboration are just as intrinsic to capitalism as competition. Subcontractors must cooperate to assemble a product, suppliers must cooperate to deliver the various components, distributors must cooperate to get the products to retail outlets, employees and managers must cooperate to reach the goals of the organization, and local governments and communities must cooperate with enterprises to maintain the local economy.'

Darwin’s understanding of natural selection is often misapplied. In its basic form, natural selection simply means that the world is constantly changing, and organisms must adapt or they will expire. The same is true of individuals, enterprises, governments, cultures and economies. Darwin wrote:"It is not the strongest of the species that survives, or the most intelligent, but the ones most adaptable to change."

Ideas, techniques and processes which are better and more productive than previous versions will spread quickly; those who refuse to adapt them will be overtaken by those who do. These new ideas, techniques and processes trigger changes in society and the economy that are often difficult to predict.

This creates a dilemma: we want more prosperity and wider opportunities for self-cultivation (personal fulfillment), yet we don’t want our security and culture to be disrupted. But we cannot have it both ways. Those who attempt to preserve their power over the social order while reaping the gains of free markets find their power dissolving before their eyes as unintended consequences of technological and social innovations disrupt their mechanisms of control.

Yet rejecting free markets also fails to preserve the power structure, for a citizenry denied the opportunity to prosper chafes under a Status Quo that enriches Elites and relegates the masses to stagnation and poverty.

The great irony of free-market capitalism is that the only way to establish an enduring security is to embrace innovation and adaptation, the very processes that generate short-term insecurity. Attempting to guarantee security leads to risk being distributed to others, or concentrated within the system itself. When the accumulated risk manifests, the system collapses.

In other words, without the fear of ruin (which is taken away by mandate by The Fed's actions - nothing shall fail), innovation and adaptation is stalled. Social Security funding is collapsing...

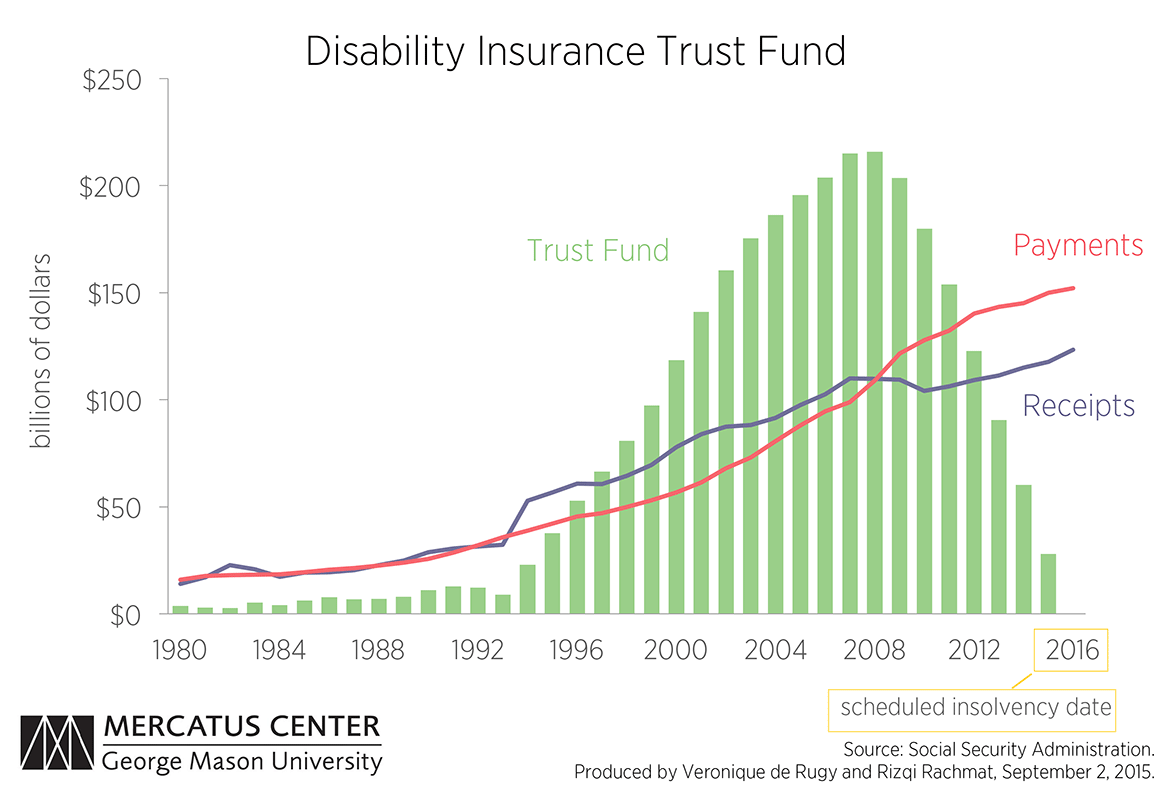

The 2015 annual report from the Social Security Board of Trustees shows that the program’s disability component is in immediate trouble. Data from the latest report show that the disability fund will be depleted as soon as next year and unable to pay full benefits to beneficiaries. This week’s first chart uses that data to show total income, expenditures, and assets in the Social Security Disability Insurance (DI) trust fund going back to 1980. The chart shows that the trust fund has been operating under deficits since 2009, as shown by the decline in the trust fund (green bars) and ever-growing gap between the payments (red line) and receipts (blue line).

Those deficits have been financed by redeeming nonmarketable government securities that were accumulated over the years when the program was bringing in more revenue than was being paid out. The government spent the surpluses on other government programs and credited the fund with the securities. But because the securities are nonmarketable, the government had to use general federal revenues to “redeem” them once the DI fund started to run deficits in order to cover the difference. With the illusion of the DI trust fund about to disappear, policymakers have no choice but to finally confront the financial imbalance that actually began years ago.

And that means your retirement is going to be 'stolen'...

Given the $42 trillion funding gap in these programs, it’s mathematically impossible for Social Security to continue funding the national debt.

This reality puts the US government in rough spot.

It’s not like government spending is going down anytime soon; it already takes nearly 100% of tax revenue just to pay mandatory entitlements like Social Security, and interest on the debt.

Plus the government itself estimates that the national debt will hit $30 trillion within ten years.

Bottom line, they need more money. Lots of it. And there is perhaps no easier pool of cash to ‘borrow’ than Americans’ retirement savings.

$7.3 trillion in US IRA accounts is too large for them to ignore.

And finally - if the next generation has a better quality of life than the last, then why is this happening...if you’re a millennial, you’d be forgiven for being disillusioned with the American dream.

As we recently noted, compared to young Americans in 1986, you’re three times as likely to think the American dream is dead and buried. As WaPo notes, "young workers today are significantly more pessimistic about the possibility of success in America than their counterparts were in 1986, according to a new Fusion 2016 Issues poll - a shift that appears to reflect lingering damage from the Great Recession and more than a decade of wage stagnation for typical workers.”

It appears that time is drawing near as Charles Hugh-Smith recently noted, the mainstream is finally waking up to the future of the American Dream: downward mobility for all but the top 10% of households.

Downward mobility and social defeat lead to social depression. Here are the conditions that characterize social depression:

1. High expectations of endless rising prosperity have been instilled in generations of citizens as a birthright.

2. Part-time and unemployed people are marginalized, not just financially but socially.

3. Widening income/wealth disparity as those in the top 10% pull away from the shrinking middle class.

4. A systemic decline in social/economic mobility as it becomes increasingly difficult to move from dependence on the state (welfare) or one's parents to financial independence.

5. A widening disconnect between higher education and employment: a college/university degree no longer guarantees a stable, good-paying job.

6. A failure in the Status Quo institutions and mainstream media to recognize social recession as a reality.

7. A systemic failure of imagination within state and private-sector institutions on how to address social recession issues.

8. The abandonment of middle class aspirations by the generations ensnared by the social recession: young people no longer aspire to (or cannot afford) consumerist status symbols such as luxury autos or homeownership.

9. A generational abandonment of marriage, families and independent households as these are no longer affordable to those with part-time or unstable employment, i.e. what I have termed (following Jeremy Rifkin) the end of work.

10. A loss of hope in the young generations as a result of the above conditions.

If you don't think these apply, please check back in at the end of the year. We'll have a firmer grasp of social depression in December 2016... and so will Warren!