Submitted by David Stockman via Contra Corner blog,

The Fed has been sitting on the funds rate like some monetary mother hen since December 2008. Once it punts again at the June meeting owing to Brexit worries it will have effectively pegged money market rates at the zero bound for 90 straight months.

There has never been a time in financial history when anything close to this happened, including the 1930s. Nor was interest-free money for eight years running ever even imagined in the entire history of monetary thought.

So where’s the fire? What monumental emergency justifies this resort to radical monetary intrusion and repression?

Alas, there is none. And that’s as in nichts, nada, nope, nothing!

There is a structural growth problem, of course. But it has absolutely nothing to do with monetary policy; and it can’t be fixed with cheap money and more debt, anyway.

By contrast, there is no inflation deficiency—–even by the Fed’s preferred measure. Indeed, the very idea of a central bank pumping furiously to generate more inflation comes straight from the archives of crank economics.

The following two graphs dramatize the cargo cult essence of today’s Keynesian central banking regime. Since the year 2000 when monetary repression began in earnest, the balance sheet of the Fed has risen by 800%, while the amount of labor hours used in the US economy has increased by 2%.

At a ratio of 400:1 you can’t even try to argue the counterfactual. That is, there is no amount of money printing that could have ameliorated the “no growth” economy symbolized by flat-lining labor hours.

Owing to the recency bias that dominates mainstream news and commentary, the massive expansion of the Fed’s balance sheet depicted above goes unnoted and unremarked, as if it were always part of the financial landscape. In fact, however, it is something radically new under the sun; it’s the footprint of a monetary fraud breathtaking in its magnitude.

In essence, during the last 15 years the Fed has gifted the US economy with a $4 trillion free lunch. Uncle Sam bought $4 trillion worth of weapons, highways, government salaries and contractual services but did not pay for them by extracting an equal amount of financing from taxes or tapping the private savings pool, and thereby “crowding out” other investments.

Instead, Uncle Sam “bridge financed” these expenditures on real goods and services by issuing US treasury bonds on a interim basis to clear his checking account. But these expenses were then permanently funded by fiat credits conjured from thin air by the Fed when it did the “takeout” financing. Central bank purchase of government bonds in this manner is otherwise and cosmetically known as “quantitative easing” (QE), but it’s fraud all the same.

In essence, Uncle Sam has gotten $4 trillion of “something for nothing” during the last 16 years, while the Washington politicians and policy apparatchiks were happy to pretend that the “independent” Fed was doing god’s work of catalyzing, coaxing and stimulating more jobs and growth out of the US economy.

No it wasn’t!

What it was actually doing was not stimulating the main street economy, but falsifying and inflating the price of financial assets. That happened directly in the Treasury and GSE (i.e. Fannie Mae and Freddie Mac) markets where the Fed made its massive debt purchases, but that Big Fat Bid obviously cascaded through the pricing mechanism of the entire financial system via the linkage of credit spreads, cap rates and carry trades, including the PE on equities.

By contrast, the mainstream Keynesian delusion that the Fed has been stimulating GDP growth rather than speculator windfalls is rooted in the hoary concept of “aggregate demand” deficiency. That is, the proposition that the macroeconomy has a natural growth rate based on potential output at full employment, and that when actual growth falls short of that benchmark, it is the job of the state—–and in recent times, especially its central banking branch——to stimulate sufficient aggregate demand to close the gap.

This is claimed to be the essence of the welfare enhancing function of the state. To wit, pushing a continuously lapsing and faltering private capitalism toward its inherent full employment potential, thereby generating jobs, income and wealth that would otherwise not happen.

Alas, that’s complete self-serving clap-trap. At the end of the day, the full employment myth has conferred opportunities for employment and power on economists who would otherwise not have much more social function than astrologists; and it has provided an all-purpose blanket of rationalization for politicians bent on using the tools of state intervention and subvention to do good, do favors and do re-election.

The truth is, there can never by an honest shortage of “aggregate demand” because the latter is nothing more than spending for consumer and capital goods that is financed from the flow of income and production. As “Say’s Law” famously and correctly insists, “supply creates its own demand”.

And even more to the point, it is “supply” that is the hard part of the economic equation. It stems from work, exertion, sweat, discipline, enterprise, innovation, invention, sacrifice and savings.

Spending from what has already been produced is the easier part. And given human nature, there is virtually no prospect of a shortage of aggregate demand——and most certainly not one which is chronic and continuous, as is implicit in the 24/7 stimulus policies of modern central banking.

Indeed, the idea that the state can create “aggregate demand” ex nihilo stems from a one-time parlor trick that was operative in the second half of the 20th century. Central banks discovered that they could stimulate credit expansion by supplying plentiful reserves to the fractional reserve banking system, thereby causing credit growth that was not funded from current savings.

That did permit a temporary breach of Say’s Law because spending derived from freshly minted banking system credit was additive to spending for consumer and capital goods financed out of current income and production. But there was a catch. Namely, continuous credit expansion resulted in the steady leveraging-up of household and business balance sheets.

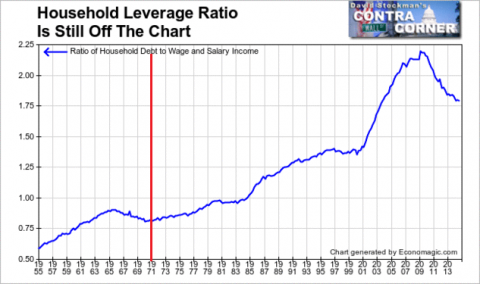

Eventually, balance sheets became saturated and a condition of Peak Debt was achieved. In the case of the household sector, leverage ratios against wage and salary income rose from a stable historic level of about 75% prior to 1980 to a peak of 220% in 2007. Then the parlor trick was over and done because in the aggregate there was no credit-worthy headroom left on balance sheets.

In fact, as shown in the chart below, the household sector has been slowly deleveraging its wage and salary income since the Great Financial Crisis. What that means is that with respect to the largest slice of the income pie by far—–the wage and salary earnings of households——Say’s Law has been re-instated. Household consumption is now constrained to the growth of production and income.

There is no more central bank “stimulus” through the household credit channel of monetary transmission.

Household Leverage Ratio – Click to enlarge

Likewise, total US business borrowings have increased from $11 trillion to $13 trillion since the fall of 2007, but it has not lead to additional investment spending. Instead, the Fed fueled inflation of financial assets has induced businesses to cycle virtually 100% of their incremental borrowings into financial engineering. That is, stock repurchases and M&A deals.

But financial engineering does not add to GDP or increase primary spending; it results in the re-pricing of existing financial assets. That is, it gooses stock prices higher, makes executive stock options more valuable and confers endless windfalls on the fast money speculators who work the financial casinos.

Indeed, as we demonstrated in a post earlier this week—–precisely 100% of the entire increase in corporate borrowing since the turn of the century has been pumped back into the casino in the form of stock repurchases. Accordingly, the business investment channel of monetary transmission is over and done, as well.

The world is drowning in excess production capacity owing to the massive worldwide credit inflation and repression of capital costs during the last two decades. That was the effect of total global credit growth from $40 trillion in the mid-1990s to upwards of $225 trillion today—-an $185 trillion expansion that exceeded the growth of global GDP by nearly 4X during the same period.

Under this condition the diversion of corporate borrowing to financial engineering and stock buybacks is a no-brainer. Prospective returns on real productive assets are jeopardized by the immense overhang of excess capacity and the unfolding contraction of profit margins and CapEx, whereas stock buybacks and M&A deals bring immediate excitement and financial rewards to the C-suite.

So we go back to the beginning. The Fed and central banks in general are pushing on a fiat credit string because Peak Debt has arrived. All of today’s massive central bank intrusion is ending up in the secondary markets where it is causing the falsification of financial asset prices and massive, unearned and ultimately destructive windfall gains to speculators.

Here’s the essence of the Keynesian full employment/potential GDP myth. The learned economic doctors have simply pulled a fancy version of the old story about the professor of economics who fell into a 30-foot hole with a colleague. At length, the latter inquired about the professor’s plan to get out. “Assume we have a ladder”, said he.

There is absolutely nothing more to potential GDP and the so-called output gap than an assumed ladder. In the context of an $80 trillion global GDP enabled by today’s massive trade, capital and financial flows and current information technology, “potential output” is impossible to measure and is constantly changing.

There is no way to know whether an auto plant is at 95% utilization or 65%; it all depends on ever-changing costs of labor, the number of scheduled shifts, the complexity of the vehicles being assembled at any moment in time and the line speed, which. in turn, is a function of equipment, automation and technology variations over time.

Likewise, when on the margin labor is deployed by the gig in the DM economies and when the rice paddies have not yet been fully drained in the EM economies, there is no reasonable, accurate or meaningful way to measure labor utilization, either.

So there is no grand Keynesian economic bathtub whose full employment dimensions can be measured; and there is no way for the Fed or other central banks to fill it right to the brim with extra demand stimulus, anyway. Peak Debt has blocked the monetary policy transmission channels.

In fact, tepid growth of labor hours, productivity and output is a supply side problem. In that respect, replacing the current burdensome 16% payroll tax on America’s high cost labor with a consumption tax on the nation’s heavily imported goods would do more for supply side growth than central bankers could ever accomplish in a month of Sundays.

Likewise, there is no want of inflation, and the 2% target is simply a central banker’s con job. By selecting the most flawed and under-stated measure possible—-the PCE deflator less food and energy—–our monetary central planners rationalize their massive usurpation of power.

But there isn’t an iota of proof that 2.0% goods and service inflation is any more conduce to real growth of output and wealth than is 1.4% or even (0.2%). In any event, there is plenty of evidence that we are and always have been at 2.0% CPI inflation or better.

When an array of the inherently flawed inflation indices are considered as shown below, there is no meaningful shortfall from 2.0% since 2010 or during the entire period when the Fed has claimed to be struggling against lowflation. And that’s especially so when the BLS’ preposterous owners’ equivalent rent (OER) is replaced with empirical gauges of housing rent inflation.

[image]https://davidstockmanscontracorner.com/wp-content/uploads/2016/04/Capture12-480x362.png[/image]

So what is to be done, as Lenin once queried?

In a word it is this. Fire the Fed. Attend to supply side policy. Let market capitalism do the rest.

The cult of central banking is dead in the water.