Content originally published at iBankCoin.com

Do not worry about anything you're about to read. In fact, close out your browsers now and go to sleep -- since it's late and you must be really sleepy.

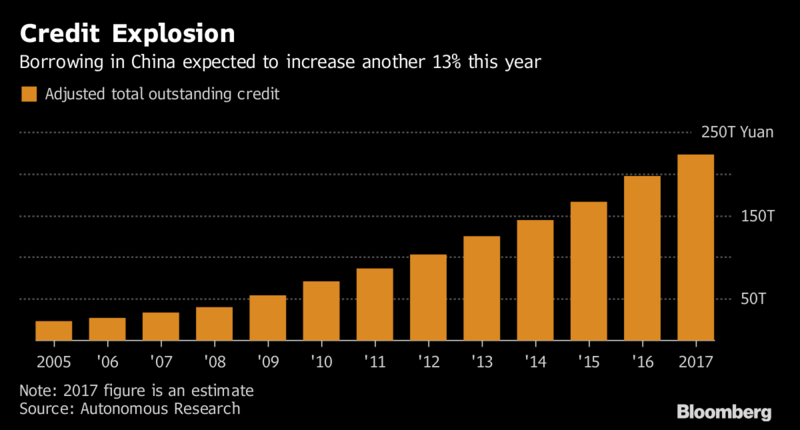

Charlene Chu from Autonomous Research is out with a note warning about Chinese credit expansion. Before we delve into the details, let's have a gander at said 'credit expansion.'

Wanton amount of credit cards

Total credit is expected to rise to 223t yuan ($33t) from 196t yuan by the end of 2017 -- an increase of ~13%, which is down from the 19% gain in 2016.

Progress.

Chu's estimates are measurably higher than the lies out of Beijing, who offered guidance of 167t yuan, which she says is bereft of local govt bond issuance and off balance sheet lending.

“It’s imperative that they start acting now, rather than continuing to push this to the future,” said the former Fitch Ratings Ltd. analyst, who made her name warning of risks from the country’s debt binge.

By her back of the envelope estimates, institutions stand to lose a potential 38t yuan -- implying a nonperforming credit ratio of 25%.

Read that again: twenty five percent.

The Chinese banking regulator, who must be doped up on Mongolian opiates, is estimating just 1.74%. What an arb!

“The overarching issue for China is that there’s a ton of credit that’s not in bank loan portfolios,” said Chu.

Yeah, I'll say.

Under this doomsday scenario of tumult, Chu is estimating the entirety of the Chinese banking sector to be cracked asunder, drowned in the blood of roguish oriental banksters. She posits a state bailout in the magnitude of 21t yuan will be needed in order to keep the savages at bay and the economy running at minimum efficiency.

In May, Moody's slashed China's credit rating, citing a 'material rise' in a pan Chinese state debt burden that might just explode.

Over the past few years, Chinese companies have leveraged up, sashaying the globe in search of plunder -- making acquisitions worth in excess of $343 billion.

Overall household, corporate and and government debt in China rings in at an astonishing $28 trillion, or 258% of GDP. Of that, $17 trillion is laden on corporate balance sheets -- who've used said credit to make expensive acquisitions. Due to this unrelenting credit expansion, the IMF is estimating that GDP will contract to +5% from 6.9% by 2021. If the country falls prey to one of those pesky financial meltdowns, analysts feel economic growth could fall below 3%.

Under this scenario, rest assured, all of your left v right bickering will be for nought -- as we'll all be dead -- eaten alive by zombie hordes.

The subsequent result of credit expansion growing at 2-3x that of GDP has led to a zombification of the economy -- strewn with failed companies kept afloat by cheap credit. A reckoning is coming and there will be little choice but to batten down the hatches and run for cover when the deleveraging begins.

In China, you're literally not allowed to fail. Credit defaults were just 0.1% last year -- compared to 2% in the US. Premier Li Keqiang said China must “ruthlessly bring down the knife” -- but they've done very little, or anything for that matter, to stop the profligate behavior embedded in the corporate sector.

“We need to see bankruptcies, lots of them,” says Michael Every, head of financial market research at Rabobank Group in Hong Kong.

If matters couldn't get worse, the Chinese property sector is now frothier as a percentage of GDP than the US housing market in 2006. Similar to the behavior witnessed during the US housing bubble, Chinese investors and flipping homes and buying and selling without even moving in -- a blue dream floating amidst unicorns and anime cartoons.

Pan China, there are upwards of 50 million units which have been purchased, but remain unoccupied.

All of this sounds dreadful, and then there's the unregulated, unwatched, $10 trillion Chinese shadow banking system. I suppose none of this matters when markets are at record highs. Maybe we should just forget about this nonsense and see about that nap now.

The Shanghai is +11.5% over the past 12 months.