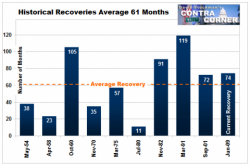

WTF Chart Of The Day: Richmond Fed Prints 9 Standard-Deviation Beat Near 23 Year Record Highs

WTF is going on? Richmond Fed's manufacturing survey exploded from -4 to 22 in March, beating expectations of 0 by the most ever). This is the 3rd highest print ever (in 23 years) driven by the highest level of New Orders in 6 years. Inventories tumbled, prices paid and received jumped, and expectations for future orders surged (despite stagnation in expectations for jobs).

WTF!

WTF!-er...

WTF!-est...

As everything exploded...

From the survey: