Post-Draghi Panic Leads To Bidding Scramble For 30 Year Paper

And so things are back to normal: following yesterday's unexpectedly poor 10 Year auction, which tailed notably while the bid to cover dipped despite it trading at the -3.00% fails rate in repo, moments ago the Treasury sold $12 billion in a 30Y reopening of Cusip RQ3, at a yield of 2.72%, stopping through the 2.731% When Issued by 1.1 bps, the most since mid-2015.

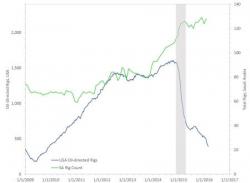

This was explainable considering the repo rate ahead of today's auction was a whopping -1.50%, which as the chart below shows, was the lowest on record.