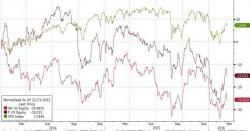

Why US Automaker Stocks Are Underperforming (In 1 Simple Chart)

Since the end of 2013, US automaker stocks have dramatically underperformed the market.

This bewildered many as auto sales surged on the back of easy credit and the entire industry was proclaimed a great success. However, the reason for the underperformance is simple - stock investors discount the future and with a mal-investment-driven excess inventory-to-sales at levels only seen once before in 24 years, they know what is coming next.