US Treasury Yields Jump As Europeans Dump Bunds

Well we warned you. Bund yields were extremely optimistic about Draghis' bazooka.. and were disappointed.

As traders dumped their Bund bets so this has sent Treasury yields jumping to the highs of the day (compressing the UST-Bund spread by 12bps)...

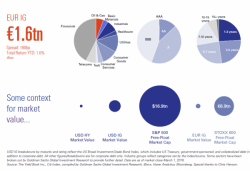

as it appears Draghi has driven a great rotation (for now) into IG credit from Treasuries.

But it seems the flow has stopped (as yields leg higher)