Trump Tweet Spikes Gold To 2-Month Highs

Extending its overnight safe-haven buying within Asia, gold has spiked above recent highs - to its highest since early June - following President Trump's latest tweet on America's nuclear arsenal...

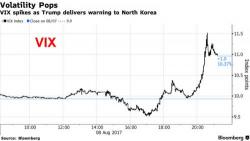

At the same time every effort is being made - by crushing VIX - to save stocks from a more perilous drop.