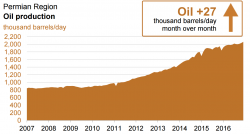

OPEC Deal Could Trigger Drilling Boom In U.S. Shale

Submitted by Nick Cunningham via OilPrice.com,

If anyone is cheering the news of an OPEC deal it is U.S. shale producers. The OPEC agreement sent oil prices shooting up this week, with WTI and Brent quickly surging above $50 per barrel.