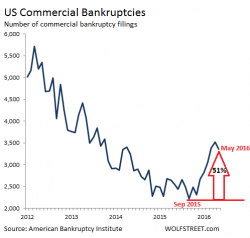

US Commercial Bankruptcies Soar (despite Rosy Scenario)

Wolf Richter www.wolfstreet.com

The post-February euphoria in the US bond market has been a sight to behold, stirred up by NIRP and QE in Japan and the Eurozone. The ECB is beginning to buy corporate bonds, including euro-denominated corporate bonds issued by US companies. This is pushing larger amounts of corporate euro bonds into the negative-yield absurdity. And it has opened all kinds of credit doors in the US.