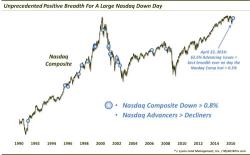

Is Breadth Signaling More Than Meets The Eye In This Market?

Via Dana Lyons' Tumblr,

Does an unprecedented show of positive breadth foretell a quick end to stocks’ recent struggles?

Via Dana Lyons' Tumblr,

Does an unprecedented show of positive breadth foretell a quick end to stocks’ recent struggles?

Submitted by Charles Kennedy via OilPrice.com,

Venezuela - home to the largest oil reserves in the world - will for the next 40 days experience a four-hour blackout every single day, and there are fears that the rationing could lead to unrest and trigger a decline in oil output at a time when the country is barely hanging on.

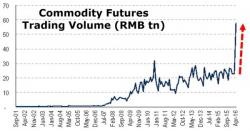

During the last week we have highlighted the frightening similarity between the speculative spike in China commodity trading (which has sent industrial metals prices soaring in yet another 'error' signal for real supply and demand) and the pump-n-dump in Chinese stocks.

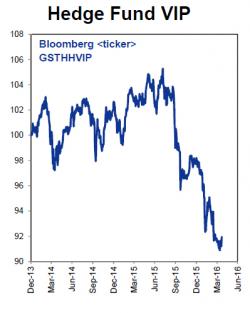

It had already been a very bad several years for hedge funds with 2016 starting off especially brutally, as Goldman's own Hedge Fund VIP basket demonstrates...

... when moments ago we learned that it is about to get even worse for one of the most iconic names in the macro hedge fund space, Brevan Howard, which according to Bloomberg has been served with $1.4 billion in cash redemption requests.

Brevan Howard co-founder Alan Howard

"Forgive the macros – they know not what they do."