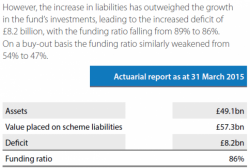

Stocks Could Easily Plunge 24% in the Next Three Months

Is the stock market setting up for a Crash?

For the first time since the 2009 bottom, Earnings Per Share (EPS) have diverged sharply to the downside from stocks.

There are a lot of reasons why investors buy stocks… but at the end of the day, they all boil down to earnings: the company is only a sound investment if it actually makes money.

The above chart shows us that earnings recently peaked and have diverged sharply from stock prices. Here’s a close up of the last three years: