In 1 Out Of Every 5 American Families, Nobody Has A Job

Submitted by Michael Snyder via The Economic Collapse blog,

Submitted by Michael Snyder via The Economic Collapse blog,

Regular readers know that we've covered Alberta's decline at length (refresher here), so there is no need to give much of a backstory other than to say that the situation seems to get worse for the Canadian province as each day passes even as oil has rebounded in the past two months.

As out friends from Fasanara Capital remind us, despite record liquidity injections by the PBOC in the past few days, Chinese repo rates have resumed continue breaking higher.

The move is odd, given ongoing record liquidity injections (RMB 680 bn last week, RMB 150 bn today).

As Fasanara's Francesco Filia writes, "the mind inevitably goes to excess credit troubles in China and potential for CNH selling-off" and adds that the "move directly affects leveraged positions on bonds, funded by short-term repos."

Outside of an exogenous geopolitical event - which given the way the world is tilting is becoming an increasingly likely occurrence - BofAML believes a bear market case is strongly supported by the probability of an economic shock most likely be tied to credit where signs of stress are building the most.

There are four simple factors that suggest problems ahead...

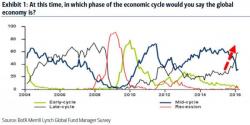

1. Investors are starting to believe we’re “late cycle”

Submitted by Mac Slavo via SHTFPlan.com,

Astute observers of financial markets, especially in the precious metals sector, have long argued that small concentrations of major market players have been manipulating asset prices. Last week those suspicions were confirmed when Deutsche Bank, one of the world’s leading financial institutions, not only admitted to regulators that they have been involved in the racket, but that they were prepared to turn over records implicating many of their cohorts in a global scheme to suppress prices.