Q1 GDP Double Whammy: Business Inventories Slide, Sales Tumble

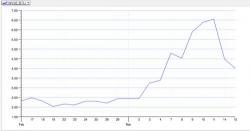

Business inventory-to-sales ratio pushes to new deeply recessionary cycle highs at 1.41x...

As inventories met expectations of a modest 0.1% drop MoM in February but sales tumbled 0.4%.

Auto inventories rose 1.3% - the most since Sept 2015 (but sales were unchanged as opposed to +1.4% in Sept 2015). The breakdown is ugly across the board...

Q1 GDP takes a double whammy as not only did inventories drop (and recent gains were revised lower) but sales tumbled.