Blast From the Past – Hillary Clinton vs. Bernie Sanders on Panama

Submitted by Michael Krieger of LibertyBlitzkrieg

Blast From the Past – Hillary Clinton vs. Bernie Sanders on Panama

Submitted by Michael Krieger of LibertyBlitzkrieg

Blast From the Past – Hillary Clinton vs. Bernie Sanders on Panama

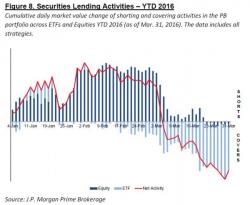

Yesterday we first reported something unexpected: when looking at the constituents of the record short squeeze that started two months ago, and still continues, traders had largely maintained kept single-name shorts, and instead covered short ETF exposure.

This followed a previous observation showing that when it comes to NYSE short interest, it is near the record highs (in absolute terms, if not as a % of market cap) reached during the financial crisis.

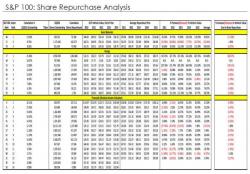

The following research was jointly produced by: J. Brett Freeze, CFA of Global Technical Analysis and 720 Global

Buying Dollar Bills For $1.10

720 Global has written four articles to date on stock buybacks and the harm these actions will likely have on future corporate growth rates and the economy. To better gauge the effect of buybacks we join forces with Brett Freeze to present a unique analysis on the S&P 100.

By Ben Hunt of Salient Partners

"My Passion Is Puppetry"

While the furious rally that proppeled gold higher in the first quarter - by the most in 25 years - appears to have fizzled, it is hardly over. So for those wondering when they should add to their position, or start a new one, here is some advice from Geneva Swiss Bank, which believes that $1,180-$1,190 "may be a good level to buy gold."

The bull case is known to everyone by now, but here it is again, from the source: