Central Banking Insider Comes Clear: QE Cannot and Will Not Create Growth

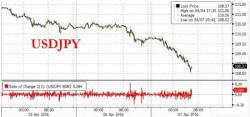

Ignore the bounce in stocks, something much larger is playing out beneath the surface.

That “something” is key admissions from Central Banks that they have lost their ability to generate anything resembling a recovery. In particular the Bank of Japan has finally come clean in an admission so startling that it took three months for the media to even catch on.

In January 2016, the head of the Bank of Japan, Haruhiko Kuroda stated that Japan has a “potential growth rate of 0.5% or lower.”