Moody's Warns U.S. Office Real Estate At "Cyclical Tipping Point" That Will Devastate CMBS Market

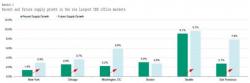

We've frequently written about the growing supply problem in the major commercial real estate markets across the country (for example: NYC Commercial Real Estate Sales Plunge Over 50% As Owners Lever Up In The Absence Of Buyers). Now it seems that Moody's is also growing somewhat concerned that growing supply, combined with waning demand and bubbly valuations, is a toxic combination for commercial office real estate projects and could result in disastrous consequences for the CMBS market. Here are the highlights from Moody's: