What Is Causing China's Yield Curves To Invert: UBS Answers

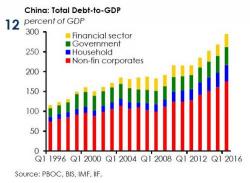

Something strange is taking place in China, and we are not talking about the largely optical, mostly irrelevant first downgrade of China by Moody's since 1989 (which still managed to unleash diplomatic hell in Beijing), and in which the rating agency simply admitted what everyone else already knew about the 300% debt/GDP economy.

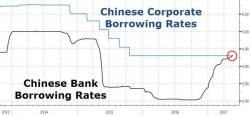

The bigger issue, as we noted previously, is that both the short-term...

and conventional Chinese funding market appears to be breaking...