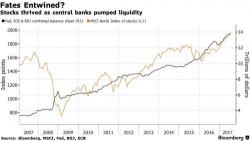

Wall Street Icon Warns The Fed's Balance Sheet Unwind "Is Very Dangerous For Markets"

Authored by Christoph Gisiger via Finanz und Wirtschaft,

Blackstone’s market maven Byron Wien warns that stocks are in danger of suffering a setback. But he also explains why investors should keep their calm and weather the impending storm.