European Stocks Soar, US Futures, Euro Jump After Failed Italian Referendum

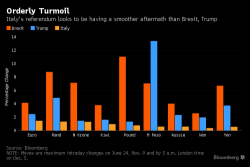

Blink, and you missed the "sell off" from Italy's failed referendum vote.

Blink, and you missed the "sell off" from Italy's failed referendum vote.

As we noted last night, when we previewed the virtually assured "No" vote, we said that "a strong “No” vote will cause Prime Minister Renzi to resign, leading to political instability in Italy.

Earlier today we reported that according to Reuters sources, the ECB was preparing for a Brexit deja vu, and was preparing to "temporarily step up purchases of Italian government bonds if the result of next Sunday's crucial referendum "rocks markets" and sharply drives up borrowing costs for the euro zone's largest debtor."

In a report confirming that the ECB is preparing for a rerun of a post-Brexit scenario, Reuters writes that the ECB is ready to temporarily step up purchases of Italian government bonds if the result of next Sunday's crucial referendum, which according to WSJ will likely determine the future of not only Monte Paschi but other insolvent Italian banks, "rocks markets" and sharply drives up borrowing costs for the euro zone's largest debtor.

European shares dipped and U.S. equity-index futures (-0.3%) pointed to a lower open as traders questioned the stability of the Italian banking sector ahead of next weekend's referendum as well as the longevity of the Trumpflation rally, pressuring the dollar, sending the USDJPY sliding as low as 111.355 overnight, before rebounding over 112. That was the dollar's biggest fall against its Japanese rival since October 7 and against a basket of top world currencies it was the greenback's worst day since November.