Deutsche Bank's Shocking ECB Rant: Warns Of Social Unrest And Another Great Depression

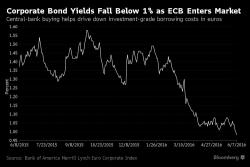

In early February, in a post titled "A Wounded Deutsche Bank Lashes Out At Central Bankers: Stop Easing, You Are Crushing Us", we showed just how vast the feud between Europe's biggest - and ever more troubled commercial bank - and the ECB had become. As DB's Parag Thatte lamented then, "ECB rhetoric suggests additional easing measures forthcoming in March.