Everything Was Working Great... And Then Today's ECB Blog Post Left JPMorgan "Dazed And Confused"

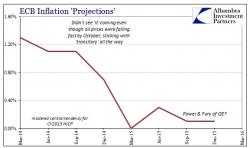

In a historic first, earlier today ECB vice president Vitor Constancio (the same one who in October 2014 explained that the European stress tests refuse to consider a scenario with deflation "because indeed we don't consider that deflation is going to happen" just a few months before Europe got its first deflationary print since the crisis) penned an official ECB opinion piece, some might call it a blog post, titled "In Defense of Monetary Policy" just hours after the ECB's historic "all in" gamble which included the first ever monetization of corporate b