France: Decomposing In Front Of Our Eyes

Submitted by Yves Mamou via The Gatestone Institute,

Submitted by Yves Mamou via The Gatestone Institute,

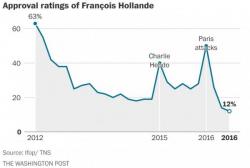

With almost 90% of the nation disapproving of him, it hardly a surprise that French President Hollande just told the nation that "for the good of his country" he will not run for Presidency in 2017 saying he was “conscious of the risks” a candidacy would have caused.

The unprecedented decision was driven by his historically low popularity ratings.

Following last weekend's latest latest "stunning" political outcome, in which French former PM Francois Fillon trounced pollsters' favorite Alain Juppe in the first round of the French conservative primary and which saw the latest political career termination for former president Nicolas Sarkozy, on Sunday the two former prime ministers are going head-to-head in a runoff vote for France's center-right presidential nomination, with the victor expected to face a showdown against a resurgent Marine Le Pen in the May 2017 presidential election.

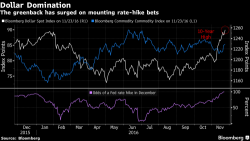

While most global equity markets were subdued due to the US Thaksgiving holiday, the FX world was very busy overnight, marked by the relentless dollar surge on expectations of a rate hike not only in December but further in 2017, sending Asian currencies to the weakest level in 7 years: the Bloomberg-JPMorgan Asia Dollar Index reached 103.32, the lowest level since March 2009.

In a quiet overnight session in which Japan was closed, European shares are mixed as financials and auto weigh, Asian stocks rise led by materials while S&P futures little changed against a backdrop of the continuing commodity rally with oil holding near $48 a barrel, up fractionally on the session. Against a basket of currencies, the dollar index was up slightly at 101.12, very close to a 14-year peak. The dollar also kept most of its recent hefty gains on the yen at 111.05 though it has met resistance around 111.35 in the last couple of sessions