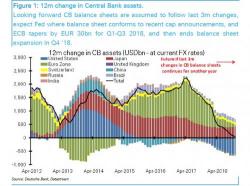

$1 Trillion In Liquidity Is Leaving: "This Will Be The Market's First Crash-Test In 10 Years"

In his latest presentation, Francesco Filia of Fasanara Capital discusses how years of monumental liquidity injections by major Central Banks ($15 trillion since 2009) successfully avoided a circuit break after the Global Financial Crisis, but failed to deliver on the core promise of economic growth through the 'wealth effect', which instead became an 'inequality effect', exacerbating populism and representing a constant threat to the status quo.