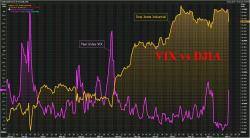

Russell 2000 Flash-Crashes

"Probably nothing..."

Small-cap stocks briefly erased gains, with the Russell 2000 plunging 0.4 percent in less than a minute as volume exploded...

As Bloomberg notes, about 3.84 million shares traded in the benchmark index at 11:51 a.m., more than 10 times the volume in the previous minute.

Trading also surged in futures, with more than 10,000 contracts changing hands between 11:50 and 11:53, 58 times the volume in the previous three minutes.