Small Cap 'Risk' Crashes To Record Low As Valuations Near Record Highs

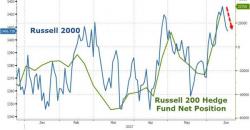

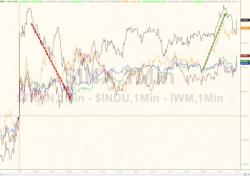

Small Cap stocks are enjoying another mini-melt-up this morning - on the back of no catalyst as usual - sending the Russell 2000 'VIX' to its lowest level in history.

Ironically this is happening as valuations for Small Caps test historical record highs...

As one trader noted tersely:

"Never been more expensive... and never been less perceived risk... what could go wrong?"