Gold Up 8% In First Half 2017; Builds On 8.5% Gain In 2016

Gold Up 8% In First Half 2017; Builds On 8.5% Gain In 2016

Gold Up 8% In First Half 2017; Builds On 8.5% Gain In 2016

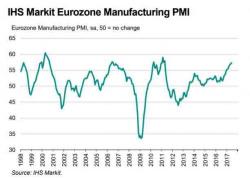

S&P500 futures have started the second half solidly in the green, up 0.3% to 2,429, tracking European markets broadly in the green, while Asian stocks fell slightly and crude oil is little changed. With US markets set to close at 1pm today trading volumes in many markets remain light before Tuesday’s July 4th holiday and as investors await Friday’s report on the American jobs market. Traders will be looking at key upcoming economic data for validation of the hawkish shift from central banks that roiled markets last week.

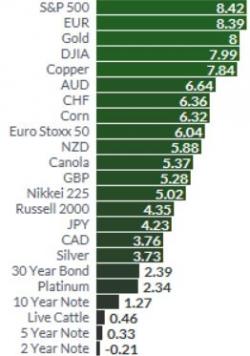

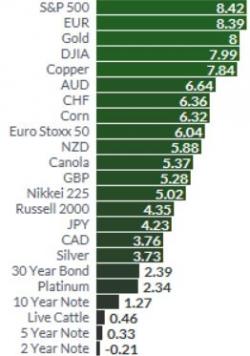

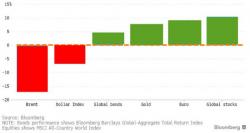

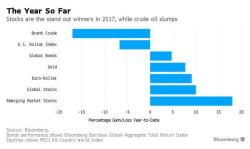

Despite a hiccup in the last week or so, global stocks survived as the best-performing asset class of the year (with the MSCI All-Country World Index wrapping up its best first half in 19 years)...

But, as Bloomberg reports, Wall Street strategists are fighting historic odds when urging investors not to chase the rally in the U.S. stock market.

They’re predicting the S&P 500 Index will see momentum fade in the second half after shares climbed 8.2 percent for the best first-half performance since 2013.

S&P futures rebounded shortly after the stronger than expected European CPI print, rising 0.3% to 2,426, as markets try to forget all about yesterday's brief 50% VIX surge and tech rout, which trimmed the seventh consecutive quarterly gain for the S&P 500 Index to 2.4%. Europe shares rose 0.4%, led by tech stocks, after a drop in Asian markets, as oil and the dollar gained.

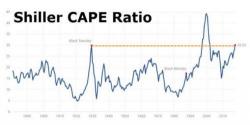

With the Shiller CAPE index having surpassed the 30x for the first time since September 2001, its creator, Nobel Laureate and Yale School of Management Economics Professor Robert Shiller is warning investors that they should be cautious about investing in such an “unusual” market.

“… the CAPE index that John Campbell and I devised 30 years ago is at unusual highs.

The only time in history going back to 1881 when it has been higher are, A: 1929 and B: 2000.”