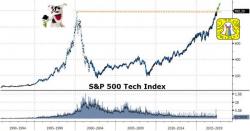

Tech Stocks Soar Past DotCom Bubble Highs: "It's Not Your Father's Market"

"Buy and Hold"... for 17 years to turn a profit.

After a nine-day winning streak the S&P 500 Technology Sector has finaly surpassed its dotcom bubble peak. Today's 992.29 close is above the previous record of 988.49 on March 27 2000.