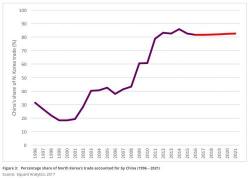

"So Much For China Working With Us": Trump Slams China On N.Korea Trade

As the G-20 meeting in Hamburg between Trump and Xi draws nearer, the US president appears eager to continue antagonizing his Chinese peer.

On his way to Warsaw this morning, where he will stay briefly ahead of the G20 summit in Hamburg which begins on Friday, Trump tweeted his displeasure at US trade deals which had been signed before his tenure: “The United States made some of the worst Trade Deals in world history. Why should we continue these deals with countries that do not help us?”