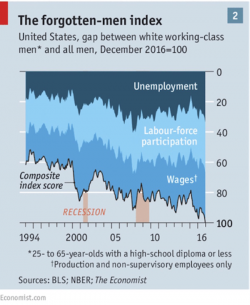

US Job Market Not As Strong As Perceived, San Fran Fed Warns

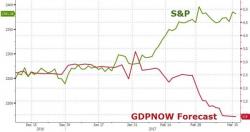

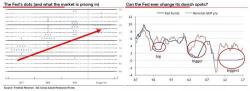

Despite endless streams of Fed Speakers proclaiming, in one form or another, that "we are at, or close to, full employment;" many in America - judging by the election of President Trump - are not feeling as exuberant as the jobs data implies they should be. The SF Fed itself now agrees: "the labor market may not be quite as tight as the headline unemployment rate suggests."