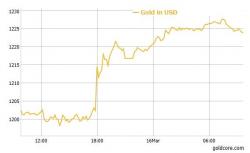

RBC: "The Fed Is Now Forced To Walk Back The Market's Incorrect Dovish Interpretation"

First, it was Goldman's chief economist Jan Hatzius, who in a fascinating note explained why the market has totally misread the Fed's tightening intentions, claiming the market surge is "not the reaction the Fed wanted", alleging that the market's dramatic "easing" response was "not the outcome the FOMC aimed for" and concluding that "at the margin, it will likely make them more inclined to tighten policy", a polite way of saying that the Fed may now not be behind the inflationary curve, but that it is certainly behind when it comes to "explaining" to the market that it has run ahead of its