China Unexpectedly Hikes Funding Rates

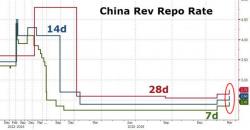

Following The Fed's 3rd rate hike in 11 years, the PBOC decided, unexpectedly, to follow in the Fed's footsteps, and tighten conditions by raising the interest rates on its open-market operations, the 7-, 14-, and 28-day reverse-repos, by 10bps each, to 2.45%, 2.6% and 2.75% respectively.

That followed an increase of 10 basis points at the beginning of February, which in turn was the first increase in the 28-day contracts since 2015 and since 2013 for the other two tenors.