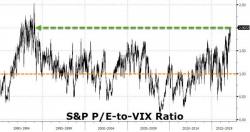

Risk-Ignorance Reaches 23 Year High As Short Interest Hits Record Low

Complacency about U.S. stocks has become so widespread that losses may lie ahead, according to Brian Belski, chief investment strategist at BMO Capital Markets. In a report Friday, Belski cited the ratio of the S&P 500 Index’s price-earnings ratio to the VIX Index, "which essentially shows how much investors are willing 'to pay' for a given level of market risk."

As Bloomberg notes, the ratio rose this month to its highest reading since 1994.