Goldman Perplexed By The "Relentless Bull Market"

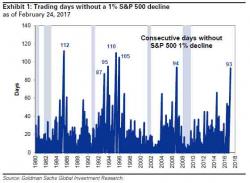

It has now become a weekly ritual: Goldman warns the market is overvalued and poised for a selloff, market proceeds to ramp to new all time highs.

It has now become a weekly ritual: Goldman warns the market is overvalued and poised for a selloff, market proceeds to ramp to new all time highs.

Submitted by Brandon Smith via Alt-Market.com,

As we previously noted, while speculatrs had been reducing their shorts in Treasury futures, they had added to Eurodollar shorts - pushing their bets on Fed rate hikes to record highs. However, as Bloomberg notes, signals are starting to emerge that traders who built up that heavy short, or hawkish, eurodollar base since the start of 2016 could be starting to throw in the towel on a March Fed rate hike.

Submitted by Mike Shedlock via MishTalk.com,

Here are two different looks at Fed rate hikes since Volcker. The charts are the same, but one presentation is a lot funnier than the other.

the above image from the New York Times article A History of Fed Leaders and Interest Rates.

Here’s an alternative view courtesy of @HedgeEye.

Let’s take the fist chart and see what correlations exist between rate hikes and the US dollar index.

Rate Hike Cycle vs. the US Dollar

Authored by Bonner & Partners Bill Bonner, annotated by Acting-Man's Pater Tenebrarum,

Exterminating Angel

Amid all the sound and fury of the Trump news cycle, hardly anyone noticed. There is a specter haunting this economy. It is the specter of inflation…

See, if you want to whip inflation now, you don’t need to do any of the really difficult things, such as printing less money… or God forbid, return to honest, market-chosen money (shudder!). All you need is intelligent nutrition!