In Ominous Sign For Fed, Bond Traders Are Betting On Flatter Curve After Rate Hike

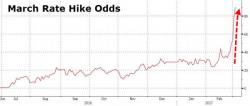

With the Fed Funds future market pricing in an almost certain 25 bps rate hike on March 15 following a series of hawkish comments by Fed officials this week, hitting 90% as of this morning, up threefold in the past week...