USDJPY Surges After Brainard Says "Rate Hike Likely Appropriate Soon"

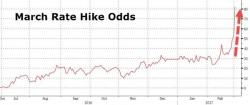

One day after a duo of Fed presidents unleashed the biggest plunge in 2 month Fed Fund futures since 2008, sending March rate hike odds from 50% to 80% in under two hours...

One day after a duo of Fed presidents unleashed the biggest plunge in 2 month Fed Fund futures since 2008, sending March rate hike odds from 50% to 80% in under two hours...

Just to clarify - Trump said nothing new at all - and added no detail, another major US retailer blew up, 'hard data' disappointed (soft surveys gained), Fed speakers were the most hawkish since Volcker, and The Dow soars 350 points to top 21,100... makes perfect sense...

While largely considered among the less relevant of Fed indicators, once one gets beyond the traditional "modest to moderate expansion pace" summary of the economy, the Fed's Beige Book release does in fact contain informative, and oftentimes useful anecdotes about the state of the economy as disclosed to the Federal Reserve. And since the latest, February, beige book comes at a time of major economic overhaul, it contained several particularly notable observations.

After President Trump's plans for renegotiating NAFTA and building a border wall have monkeyhammered the Mexican Peso to record weakness, it appears Banxico has found a friend to help defend its currency - The Fed.

Bloomberg reports that, according to three people with knowledge of the discussions, Banxico is considering requesting swap line with Fed to ensure liquidity in peso trading should volatility jump.

And The peso is surging...

An avalanche of hawkish Fed speakers appear to have got their way as March rate-hike odds have extended yesterday's move to 82% this morning. As stocks soar after a more presidential Trump, bond yields are also rising, catching up to stocks after diverging for two weeks.

From 24% to 82% in 3 weeks... did the economic data shift that much?

Umm no...

Stocks are soaring... bonds playing catch up for now.

But while bond yields are higher - 30Y above 3.00% - though the move is fading now...