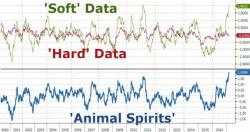

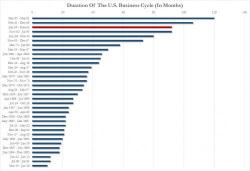

Reflecting on the week - a week that saw 7 Fed speakers go full hawktard and drive rate hike odds at a pace never seen before, a week in which hard data tumbled to pre-election lows as 'soft' surveys all hit record highs, a week in which Small Cap stocks tumbled red (but but but they're domestic focused) as bank stocks soared, a week in which The Dow spiked to 21,100 on the back of the biggest retail ETF inflows in 3 years, and a week that saw a virtual currency's price top gold's for the firs time ever - we thought this was appropriate... (NSFW!!)