China Unveils Plan To Combat Trump Tax Reform: “We’ll Have Tough Battles"

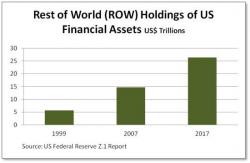

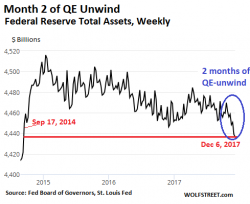

With Donald Trump's historic tax reform on the verge of passage, and with the Fed continuing its rate hiking cycle so far undeterred, and according to the Fed's own dot plot still having another 7-8 rate hikes to go, China is getting nervous because, as the WSJ reports, it fears "a double whammy sapping money out of China by making the U.S. a more attractive place to invest." In other words, those capital outflows which China was confident it had finally bottled up, are about to return. And that's even as the U.S.