Albert Edwards: "Here's Why The Current Situation Is Even Worse Than The 2008 Crisis"

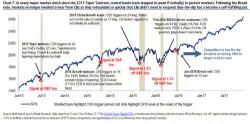

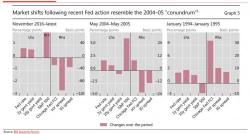

Back in May, we first reported that Goldman became the first bank to dare to ask if the Fed has lost control of the market, if in slightly more polite terms of course. This is how Jan Hatzius phrased it: "Despite two rate hikes and indications of impending balance sheet runoff, financial conditions have continued to loosen in recent months.