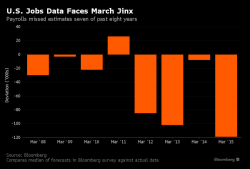

Goldman Looks At The Jobs Report, Sees Three Rate Hikes In 2016

The FOMC may have cut its rate hike forecast from 4 to 2, following by an even more dovish speech by Janet Yellen, but Goldman is convinced the Fed is wrong. As a result, after looking at today's payrolls report, its chief economist Jan Hatzius said that "we ultimately think the committee will move faster than the two-hike pace implied by the latest “dot plot”, despite the dovish signals from the March meeting and Chair Yellen’s remarks this week" and that "we continue to expect the FOMC to raise rates three times in 2016."