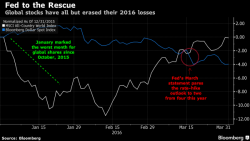

Chicago Fed's Evans Goes From Hawkish To Dovish And Back To Hawkish Again In Under 2 Weeks

Just one week ago, when the US dollar was surging when one after another Fed president were making hawkish statements (who can forget Bullard's forecast that a rate hike may occur as soon as April), one of the speeches which surprised the market the most, was that by Chicago Fed's permadove Chuck Evans, who on March 22 said that the Federal Reserve is on track for "gentle, gradual" rate hikes unless economic data comes in a lot stronger than expected or inflation picks up faster than anticipated, a top Fed official said on Tuesday.