Fed Levitation & The Looming Liquidity Trap

Submitted by Lance Roberts via RealInvestment Advice.com,

Fed Levitation

Submitted by Lance Roberts via RealInvestment Advice.com,

Fed Levitation

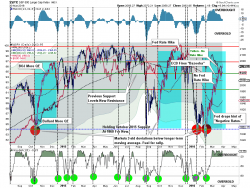

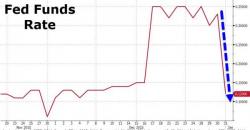

Back on December 31, the day which was the first quarter and year-end after the Fed's first rate hike cycle in nearly a decade, we pointed out something unexpected - the Fed's rate hike corridor had just been broken when the Fed Funds rate traded as low as 0.12%, far below the mandated minimum of 0.25%.

Back in November, when it was laying out its (five out of six wrong) Top Trades and predictions for 2016, Goldman strategists forecast that because the "US will be the first to grow GDP demand above potential" the stock market party would be over and that the "Bernanke Put" would be replaced with the "Yellen Call."

Specifically, this is what Goldman predicted:

Last night we noted the odd "messaging" that was apparent in The PBOC's Yuan fix shifts into and after The Fed and Janet Yellen spoke...

Almost as if The Fed had "outsourced its monetary policy" to China once again. But as DollarCollapse.com's John Rubino notes, it appears Janet Yellen has instead outsoured US monetary policy to the financial markets...

The Fed failed to hike interest rates in March despite the “data” hitting levels at which the Fed said it would hike. Indeed, the Fed even lowered its expected number of rate hikes for this year from four to two!

This confirms for us that the Fed does indeed want inflation.

In the last few weeks, several Fed officials, most notably Fed Vice-Chair Stanley Fischer stated not only that inflation was appearing in the US but that this is something the Fed “would like to happen.”