Peter Schiff Warns "The Fed Is Stuck In The Same Monetary Mud As In 2008"

Submitted by Peter Schiff via Euro Pacific Capital,

Submitted by Peter Schiff via Euro Pacific Capital,

"Is the Fed confusing the market?"

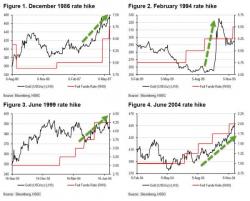

Gold has historically rallied for at least 100 trading days after the first hike by the FOMC, but as HSBC's Jim Steel explains, this time it could be longer. Steel sees three key reasons to remain bullish and forecasts USD1,300/oz this year (though warns that beyond that level, physical demand may weaken and help curb further rallies.)

Tightening and gold Background: The end of the long-run bull market

Earlier today Fed President Evans said this "I think the economic fundamentals [of the US] are really quite good." As the following three charts show, there is only one thing that looks "quite good" and it is not 'economic fundamentals'...

Federal Reserve Bank of Chicago President Charles Evans says “we expect 2016 growth will be 2 to 2.5 percent and I think the fundamentals are really quite good for the economy going forward.”

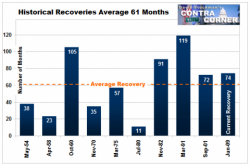

Submitted by David Stockman via Contra Corner blog,

Simple Janet should have the decency to resign. The Fed’s craven decision last week to punt on interest rate normalization is not merely a reminder that she is clueless and gutless; we already knew that much.