The Unintended Consequences Of Greenspan's "Frankenstein" Markets

Submitted by Eugen von Bohm-Bawerk via Bawerk.net,

Submitted by Eugen von Bohm-Bawerk via Bawerk.net,

Submitted by EconomicPrism's MN Gordon, via Acting-Man.com,

Winter of Discontent

Former Federal Reserve Chairman Alan Greenspan resurfaced this week. We couldn’t recall the last time we’d heard from him. But, alas, the old fellow’s in desolate despair.

Unexpectedly rising from the crypt: Alan Greenspan

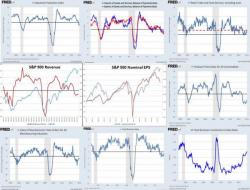

"There are no signs of a US recession anytime soon"... apart from these nine charts that is..

Source: @DonDraperClone

Of course, even The Fed is forced to admit that recession probabilities are rising fast...

The latest reading from last November is higher than all but 3 months (in the last 50 years) when a recession did not immediately proceed.

Nomura's Bob Janjuah warend in January that "the bubble implosion can't be fixed this time," and, as he explains in his latest note, he is pleased with all six of his key forecasts for 2016...

In particular on Commodities, with his expectation that crude would trade below $30 (the price per barrel fell from $37 in early January to a low so far of $26 in February).

Moments ago, for some unexplained reason, the St.Louis Fed - which recently issued a research report which "discovered" that "Consumers Across The Country Are Borrowing More To Buy Cars And Go To School" - on its twitter account asked a simple question: "See how the ECB's assets are growing?"

See how the European Central Bank's assets are growing https://t.co/cjQBj8y2VP pic.twitter.com/ozbnMU7Kh0

— St. Louis Fed (@stlouisfed) March 5, 2016