The Fed Remains On Course... To Trouble

Authored by Thorstein Polleit via The Mises Institute,

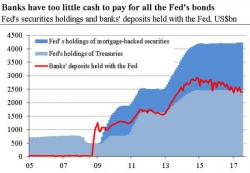

The Federal Reserve (Fed) is widely expected to continue to tighten its monetary policy this year. According to a latest Reuters Poll, the Fed is likely to start shrinking its US$4 trillion balance sheet in September and, moreover, raise further its key interest rate, which is currently standing in a range of 1.0 to 1.25 percent, in the fourth quarter this year.