Central Banks Are Driving Many To Cryptocurrencies

Authored by Dmelza Hays via The Mises Institute,

Authored by Dmelza Hays via The Mises Institute,

Authored by Chris Martenson via PeakProsperity.com,

Global macro economic data has been weak for many years, but there’s now a very real chance of a world-wide recession happening in 2017.

Why? A dramatic and worsening shortfall in new credit creation.

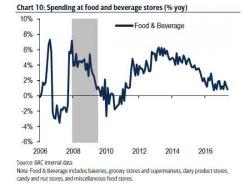

When describing the logic behind Amazon's blockbuster acquisition of Whole Paycheck Foods, a deal that made the "greedy bastards" over at Jana Partners $400 million richer in just a few months, Credit Suisse analyst Stephen Ju explained that he views this acquisition as "an offensive expansion move to accelerate its progress in the largest consumer spend category. In other words, Amazon is paying roughly 3% of its enterprise value for an improved position in an addressable segment that amounts to ~$1.6 trillion according to the US Dept.

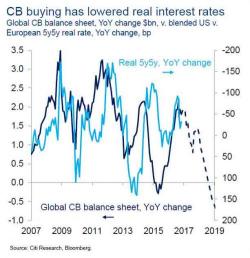

Earlier this week we discussed a chart from Citi's Hanz Lorenzen, which we said may be the "scariest chart for central banks" and showed the projected collapse in central bank "impulse" in coming years as a result of balance sheet contraction, and which - if history is any indication - would drag down not only future inflation but also risk assets. As Citi put it "the principal transmission channel to the real economy has been...

By Bill Blain of Mint Partners

Blain’s Morning Porridge

“Sometimes I’ve believed as many as six impossible things before breakfast.. ”

* * *