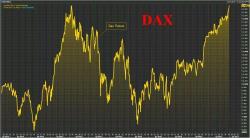

Global Stocks, US Futures Rise On First Day Of Q2 As Trump-Xi Meeting Looms

After the best quarter for US stocks since 2015, global equities have started off Q2 on the right foot, despite caution about the upcoming meeting between President Trump and China's Xi Jinping later this week, and Fed Minutes which are expected to be more hawkish than the FOMC statement.