Convergex: "Where Do We Go From Today's Selloff: There Are 2 Positive Outcomes, And 1 Negative"

From Nick Colas of Convergex

Loose Lips Sink, Well Everything

From Nick Colas of Convergex

Loose Lips Sink, Well Everything

A risk-off mood dominated the overnight session amid growing concern over the turmoil engulfing the Trump administration, as fresh allegations add to deepening political scandals in Washington, the latest coming from Tuesday's NYT report citing former FBI director Comey’s memo which raises possibility of obstruction of justice, an impeachable offense. The dollar, already in retreat after a report that the U.S.

The “Trump trade” in U.S. stocks that was spurred by President Donald Trump’s November election has come and gone, according to Tony Dwyer, Canaccord Genuity Group Inc.’s chief market strategist.

From Nicholas Colas of Convergex

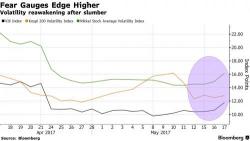

Today we continue our recent exploration of the ongoing low volatility in US equity markets, but with a novel twist. Instead of looking at the CBOE VIX Index, we look at the historical trends in actual S&P 500 price volatility. Not only is the dataset longer here (starting in the 1950s rather than 1990), but it is also “Stickier” than the twitchy VIX.

Three takeaways.

Via Francesco Filia of Fasanara Capital

“Learn how to see. Realize that everything connects to everything else.” – Leonardo da Vinci

Hard data ceased to be a driver for markets, valuation metrics for bonds and equities which held valid for over a century are now deemed secondary. Narratives and money flows trump hard data, overwhelmingly.