Things Just Got Even Weirder

Via ConvergEx's Nicholas Colas,

Just when you thought the 8 year bull market for US stocks had shown us everything, something new comes along.

Via ConvergEx's Nicholas Colas,

Just when you thought the 8 year bull market for US stocks had shown us everything, something new comes along.

The first time we explained that one of the biggest risks facing a world in which the dollar is the reserve currency is a global USD shortage, was in mid-2009, when we wrote "How The Federal Reserve Bailed Out The World."

In light of the only thing that matters for markets (that would be Donald Trump for those who have slept through the past three months), here are some salient thoughts from the latest weekend notes by One River Asset Management's Eric Peters, whose uncanny ability to put a unique spin on events in third person continues to impress.

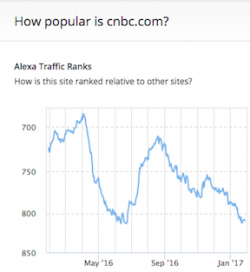

As markets continue to break record highs, the echelon of premier finance sites in America continues to undergo deleterious drawdowns in their traffic. Anyone who operates a finance site knows that lack of volatility is the death knell for traffic. People aren't interested in reading about stocks, generally speaking, when markets are effervescently gliding towards new highs. They are, in fact, keenly interested in horrible news and/or rapidly declining equity prices.

The general sentiment on the Convergex trading desks continues to be bearish, so today Nichaolas Colas reviews seasonal patterns for the CBOE VIX Index going back to its starting point in 1990 to see what that math says about current market risk.