It appears we can now add "consumer confidence" to fake news trash heap.

Roughly at the same time as the allegedly apolitical Conference Board reported the highest consumer confidence print in 17 years...

... not to mention the most optimistic outlook on stocks since 2 months before the dot com bubble burst, a very different number emerged from a similar poll by Gallup.

First, a reminder of what the Conf. Board said this morning:

“Consumer confidence increased sharply in March to its highest level since December 2000 (Index, 128.6),” said Lynn Franco, Director of Economic Indicators at The Conference Board. “Consumers’ assessment of current business and labor market conditions improved considerably. Consumers also expressed much greater optimism regarding the short-term outlook for business, jobs and personal income prospects. Thus, consumers feel current economic conditions have improved over the recent period, and their renewed optimism suggests the possibility of some upside to the prospects for economic growth in the coming months.”

The result was based on a random survey of 3,000 people in the latest month.

Meanwhile, in the week of March 20-26, Gallup surveyed a random group of (supposedly different) 3,547 adults, and found something completely different, namely that

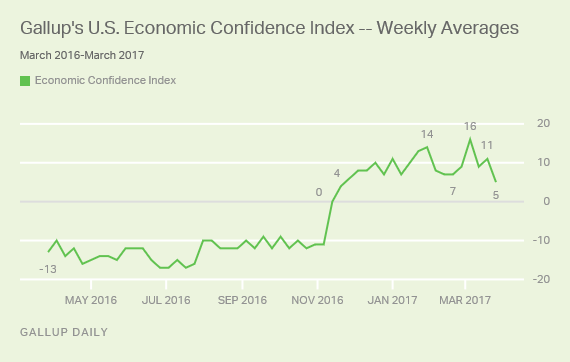

"Americans' confidence in the U.S. economy tumbled along with the Dow Jones industrial average last week. Though still in positive territory, Gallup's U.S. Economic Confidence Index (ECI) dropped six points to a score of +5 for the week ending March 26. This is the lowest weekly average since the presidential election in November."

How is this divergence possible? Simple: Gallup actually admits the reflexive nature of the primary driver of "confidence", the stock market... the same stock market which according to headlines on CNBC and elsewhere jumped today because consumer confident rose. "Americans' falling confidence in the economy may be tied to events in Washington and on Wall Street. Last week, the Dow logged its worst week since September as congressional Republicans ultimately failed to vote on legislation that would repeal and replace the Affordable Care Act."

That, however, is hardly the entire story, because confidence waned prior to the effort to replace the ACA dying in Congress on Friday. "This suggests that the broader GOP infighting earlier in the week, rather than the decision to pull the bill itself, may have been a factor, in addition to the market's poor performance."

And yet, none of this decline was captured by the Conference Board, almost as if it serves a specific political, or maybe market manipulating purpose.

As Gallup also adds, confidence did not drop evenly across party lines. Rank-and-file Republicans became significantly less confident in the economy last week, with their index score falling to a still-robust +42 from +52 the week before. Independents, too, lost confidence, with their score retreating back into negative territory to -1 from +6 the previous week. Democrats' confidence in the economy changed little, with their current -20 score similar to the -18 they had in the week prior.

That was not all: Americans' assessments of current economic conditions took a seven-point hit for the week ending March 26 after reaching a high of +17 in the prior week. This loss marked the largest drop for this component since the federal government shutdown in October 2013.

The current +10 score is the result of 32% of Americans rating the economy "excellent" or "good," and 22% rating it "poor." This collapse in current economic conditions was strangely missing from the group of 3,000 adults polled by Nielsen which does the Conference Board surveys.

Meanwhile, Gallup's economic outlook component of the ECI fell five points, but enough to send this component back into the negative territory for the first time since the election. Americans' economic outlook had already dropped significantly in March. The current -1 score is the result of 46% of Americans saying the economy is "getting better," and 47% saying it is "getting worse."

[image]https://content.gallup.com/origin/gallupinc/GallupSpaces/Production/Cms/POLL/e5i5dnezj0k6cxj9xkvmhq.png[/image]

The Gallup bottom line: "A rocky week on Wall Street may have hurt Americans' confidence in the economy's health. The failure of Republicans to repeal the ACA didn't seem to immediately affect confidence further, at least in the short term. However, if losses on Wall Street continue this week, the situation may contribute to further erode confidence in the coming days. If confidence does fall more, it may result in Americans' net evaluation of the economy growing more negative than positive for the first time since the election.

Donald Trump's election spurred a renewed level of confidence among his fellow Republicans, which boosted the overall average for the index into positive territory. But, if his supporters perceive that the promises he made during the campaign are not being kept, or if Republicans lose faith in Trump's negotiating prowess, the party rank and file could become further depressed.

So which data is right: the Conference Board's surge to near record highs, or Gallup's "plunge" to the lowest of Trump's tenure? Frankly, at this point, with every other piece of (fake) news, data and analysis having the same credibility, what difference does it make...